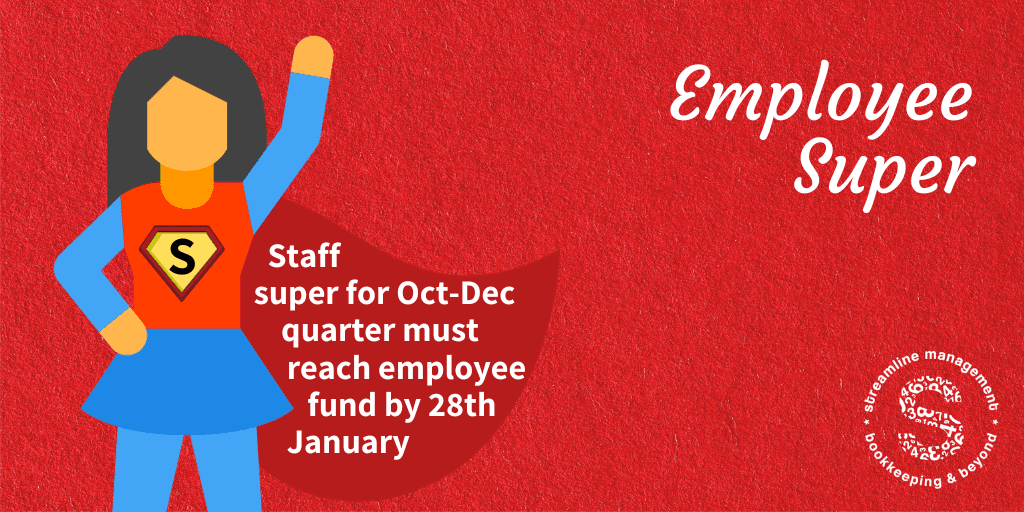

Employee super must be paid on time!

Super payment due dates occur quarterly. If you don’t pay an employee’s super guarantee (SG) amount in full, on time and to the right fund, you must pay the super guarantee charge (SGC).

The SGC is more than the super you would have otherwise paid to the employee’s fund and is not tax deductible.

You will need to complete an SGC statement and submit it to the ATO, this is used to calculate fines and penalties (some to compensate staff for lost earnings, some to punish you for naughtiness).

Hopefully this is a mistake you only make once!